Achieve peace of mind through education.

Understanding Your Monthly Electric Bill.

What is the one product that you buy all day, every single day? Homeowners purchase hundreds of thousands of “kilowatt-hours” which is just a unit of measure of electricity. We unconsciously buy these units throughout our lives from the utility companies without even thinking about it most of the time.

Like any other business, utility companies charge us based on the amount of money they need to cover their operating costs and to turn a profit. The utility companies determine how much they charge based on 4 key factors: Basic Customer Service, Generation Service, Transmission Service, and Distribution Service.

The Outdated Model

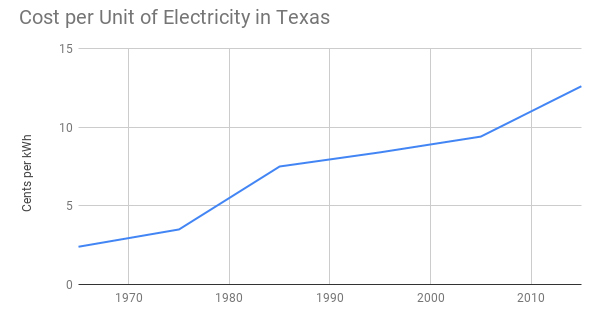

Your electricity is expensive and increases every year because utility companies have to spend money in order to maintain this complex process, buy new equipment, and turn a profit.

Basic Customer Service Charge

This is a fixed amount your utility company charges you for being a customer. It’s similar to a “convenience fee” that you pay for when purchasing concert tickets.

Generation Service Charge

This is the actual cost of the electricity you use. The cost per unit is determined by your utility company and increases every year.

Transmission Service Charge

Before electricity arrives at your home it has to be generated, but where is it made? Power plants create electricity from coal and fossil fuel sources and can be located hundreds or even thousands of miles away from your home (they’re in rural areas because they’re constantly emitting dangerous pollution). The power plant sends electricity through massive towers and cables up to 765,000 volts. These massive towers carry the electricity long distances from city to city or state to state. Before the fossil fuel generated electricity makes it to your home, it has to make a stop at a sub-station which houses the equipment that changes the electricity from one level to another. The electricity coming from the transmission lines run through a large sub-station transformer that steps down the voltage to a lower level (usually around 34,500 – 7,200 volts) which is still too strong for your home.

Distribution Service Charge

Once the electricity has been transformed to lower levels, the distribution service process carries the lower voltage electricity from neighborhood to neighborhood. The distribution process uses the power lines that you see in cities and neighborhoods every day. On every power pole there is a transformer that brings the electricity down to the final voltage level appropriate for your home (either 120 or 240 volts). From there the electricity runs to your home’s utility meter. Your meter measures every unit of electricity used by your home and appliances. At this point the electricity has arrived at your home.

How do you want to power your home?

The Old Way

- Coal

- Fracking

- Natural Gas

- Expensive Pricing

- Carbon Emissions

The New Way

- 1. Sunlight

- 2. Clean Energy

- 3. Sustainable

- 4. Fairly Priced

- 5. Energy Independent

The Rising Cost of Electricity

As of January 2020, the average American household purchases 1,174 kilowatt-hours from their local utility company each month. The price they pay per kWh on average is 12.9 cents.

1,174 units x 12.9 cents per unit = $151.44

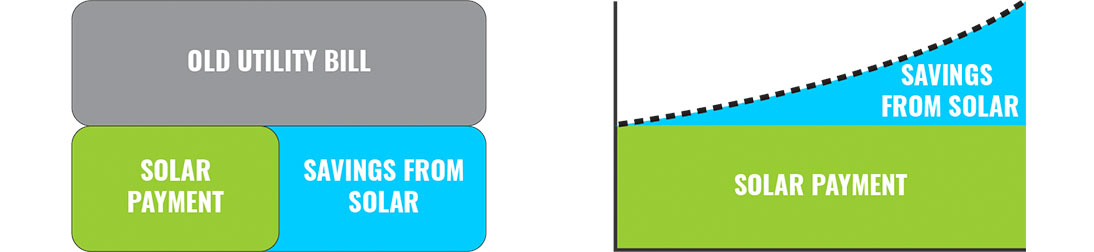

When you invest in a solar system you stop buying fossil fuel generated electricity. With solar, the panels on your roof generate kilowatt-hours from natural sunlight. The solar electricity travels only about 20 feet from your roof to your home. The best part? Say goodbye to unpredictable utility rate increases. Your monthly solar investment payment is fixed so you know exactly what you’re going to be paying every month.

How Solar Energy Lowers Your Bill

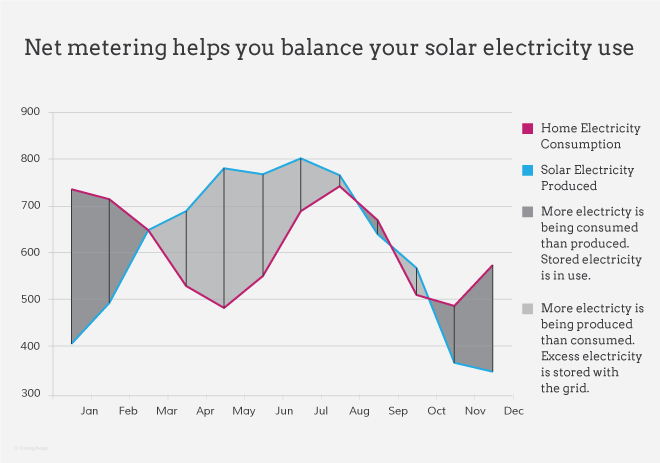

Net-metering explained

When you go solar, your utility company credits your monthly bill for every kilowatt-hour (kWh) your panels generate. Your solar panels can generate more kWh than your home uses month to month, giving you a surplus of kWh credits with most utility companies.

Example: Your home uses a total of 1,000kWh in May and your solar panels generate a total of 1,100kWh. Since your home did not use more energy than your panels generated, your utility only charges their small basic customer service charge. The surplus of 100kWh will roll over to June’s bill.

During some months (mostly in winter) your solar panels may generate less than the total amount of kWh your home uses, leaving you with a bill only for the difference.

Example: Your home uses a total of 1,000kWh in November and your solar panels generate a total of 900kWh. The utility bill for November would be for a basic customer service charge PLUS 100kWh of electricity MINUS whatever roll-over credits you had for the trailing month(s).

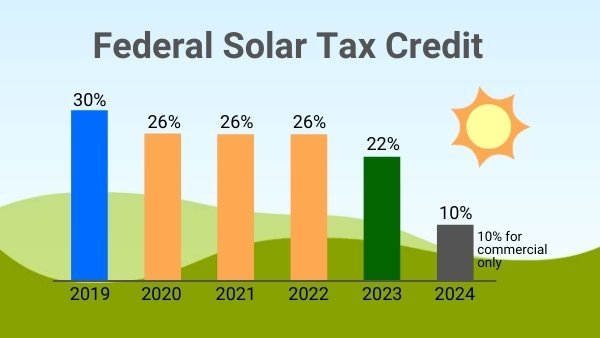

Save 26% on Solar in 2021

In 2005, under the George W. Bush administration and The Energy Policy Act, the solar investment tax credit was born. The Solar ITC allows a homeowner to deduct 26% of the total investment of their solar panels from their personal tax liability if they were installed between January 1, 2006 and December 31, 2007. Later in 2006, the 30% solar investment tax credit got extended for one more year until December 31, 2008. In 2008, the 30% solar investment tax credit got extended for 8 years until 2016! This extension helped create the largest amount of solar installations the United States had ever seen. In 2015 it was again extended through 2023, however, the tax credit amounts would change after 2019. Right now the solar investment tax credit is 26%. In 2021, it will be reduced to 22% and in 2022 there won’t be a solar investment tax credit for homeowners. The timing is RIGHT NOW to go solar. This is the last year to be able to receive 26% of your solar investment back as a tax credit which is as good as cash.

The time to go solar is NOW!

Solar ITC Common Questions:

How does a homeowner apply for the 26% solar investment tax credit?

It’s simple. You just need to fill out IRS Form 5695 and include it your income tax filing that you or your account fill out for that year.

How do I know if I'm eligible for the 26% solar investment tax credit?

- You own your system though a solar loan or cash purchase. Solar leases are not eligible.

- You have a federal tax liability equal or greater than 26% of your solar installation.

- If your federal tax liability is lower than 26% of your solar installation the remaining amount will simply roll over to the following years federal tax liability.

How do I use the 26% tax credit if I get a solar loan?

Example: John goes solar in 2020. He invests in solar by taking out a solar loan. John’s solar loan payments over 20 years equals a total of $30,000. Even though John invested in his solar panels without spending any upfront money he will still see $10,000 (26% of his total solar investment) come back as a tax credit to be applied towards his solar loan.

How do I use the 26% tax credit if I pay cash for my solar panels?

Example: Jane goes solar in 2020. She invests in solar by writing a check to her solar panel installer in the full amount. Jane’s solar panel installation costs a total of $30,000. When Jane does her taxes at the end of the year, she will indicate that she spent $30,000 on solar panels and see a $10,000 tax credit, as good as cash, on her April federal tax return in 2021.

Why is investing in solar so smart?

You’re taking the money you give to the utility every month and investing into your house.

- The Federal Government is giving you 26% of your investment back

- An immediate return on your investment once you activate your panels

- The addition of an asset that increases your home’s value right away

- A dramatic reduction in the cost of energy from your current utility company

- Helping your local economy.

- Supporting new job creation within the renewable energy sector

- Contributing to the energy independence of the United States

- Mitigating climate change by greatly reducing your home’s carbon footprint

Solar Financing

A solar loan allows homeowners to invest in solar panels with no upfront cost & a 650 FICO score. Solar loans have a low monthly payment for either 10 or 25 years. Within the first 18 months, homeowners receive the 26% federal solar tax credit on their tax returns. In turn, the dollar amount of the 26% tax credit can be applied to the solar loan. Contact us to find out if you qualify today.